Pfizer Shares: Is this a right moment to buy them? | March 2024

Katarína Kukanová

About Pfizer

Pfizer, founded in 1849, is an American multinational pharmaceutical and biotechnology company. Headquartered in Manhattan, New York City, Pfizer is a leading biopharmaceutical company that has been at the forefront of scientific innovation for 175 years.

Major drugs: Penicilin (World War II) - Viagra (1989) - Comirnaty (2020) - Padcev (Seagen)

Pfizer pipeline: Inflammation and Immunology - Internal Medicine - Oncology - Rare Disease - Vaccines

By 2030, Pfizer is poised to introduce 8 or more potential blockbuster drugs, with biologics projected to account for approximately 65% of Oncology revenues, a sharp increase from about 6% in 2023.

Turnover for the full year 2023: $58.5 billion.

2023 Completion of the acquisition of Seagen Inc (Oncology ADCs Biotech)

Expected 2024 sales of USD 58.5 to 61.5 bn (compared to expected USD 63.17 bn)

Expected net cost savings of at least USD 4.0 bn in 2024

New York Stock Exchange Pfizer shares: USD 27.22 (March 11, 2024) compared to USD 39.39 (March 10, 2023)

Peer group: AbbVie Inc, Amgen Inc, AstraZeneca PLC, Bristol-Myers Squibb Company, Eli Lilly and Company, GSK plc, Johnson & Johnson, Merck & Co, Inc, Novartis AG, Novo Nordisk, Roche Holding AG and Sanofi SA

Objectives, Questions & Hypotheses

Objectives:

Questions:

Hypotheses:

Methods

Financial Analysis: Conduct a comparative analysis of Pfizer's financial performance, valuation, financial health, and profitability, against its major competitors.

Product Portfolio Analysis: Evaluate Pfizer's current product portfolio and pipeline, assessing the strength of its key therapeutic areas, patent expirations risks, and potential future blockbusters.

Market Positioning Analysis: Assess Pfizer's market share, growth potential, and competitive advantages in key therapeutic areas and geographic markets.

SWOT Analysis: Identify Pfizer's strengths, weaknesses, opportunities, and threats in the context of the broader pharma/biotech industry and its major competitors.

Introduction

The pharmaceutical and biotechnology industry is traditionally characterized by high research and development costs, stringent regulatory requirements, and intense competition. The industry is focused on developing innovative therapies, with a growing emphasis on personalized medicine and targeted therapies, particularly in oncology. There have been several reports on the state of pharma/biotech industry in 2023 published recently, such as J.P. Morgan Annual Biopharma Licensing and Venture Report, or PwC Pharmaceutical and Life Sciences Deals Outlook. The reports highlight following trends in biotech & pharma industry for 2024: strong focus on innovation and personalised medicines, especially in the field of oncology therapies, advanced biologics, antibodies, and complex molecular programs, rising operational costs placing pressure on the bottom line, market access challenges due to Inflation Reduction Act (IRA), impact on gross-to-net pricing, AI-driven transformation of drug discovery, clinical trials and patient engagement, task automation, reimagination of supply chains, continuing M&A, grow of cell and gene (CGT) market by 20%.

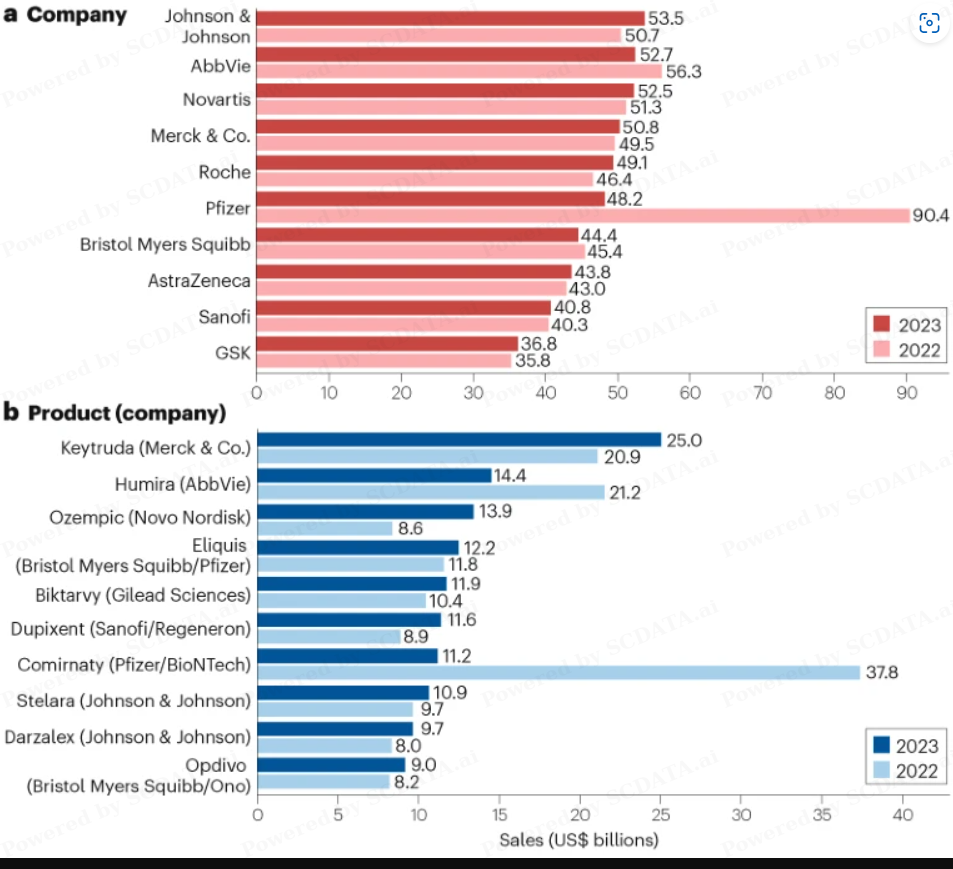

With 9% of the worldwide market share and over 80,000 employees Pfizer is one of the world's largest pharmaceutical companies, with a diverse product portfolio and a strong presence in various therapeutic areas, including oncology, immunology, and rare diseases.. Due to sales of its Covid-19 vaccine Comirnaty and Paxlovid Pfizer was at the top of the pharma industry rankings for several years. In 2023 the sales of Covid medicines declined significantly without being anticipated, which caused Pfizer fell from 1st to 5th place in the ranking of pharmaceutical companies (Nature, Top companies and drugs by sales in 2023, March 8, 2024) and being outpaced by Johnson&Johnson, AbbVie, Novartis, Merck&Co., and Roche. Pfizer´s 1 Y Sales has decreased by 41,70% (March 11, 2024).

Pfizer´s Most important competitors: Novartis, Johnson & Johnson, Roche, Merck & Co., and AstraZeneca.

Part One World Pharmaceutical Market

Enterprise Ranking

Katarina Kukanova

Author unit or other information

Nature | Best Pharma Companies & Drugs By Sales | March 2024

Part One | World Pharmaceutical Market & Enterprise Ranking | 2022 - 2024

Statista data shows that the global pharmaceutical market is growing continuously. It is unlikely that this trend will reverse in the near future, but we must point out that there are several potential disruptive factors that could lead to a decline, such as pressure on the supply chain from geopolitical tensions, inflation, regulatory hurdles, economic instability, wars, terrorism or environmental disasters.

The 2022 SC data shows Pfizer's strong position in the global pharmaceutical market due to the success of its Covid-19 drugs, which unexpectedly declined significantly in 2023.

The 2024 ranking by Nature demonstrates that Pfizer remains one of the market leaders in the global pharmaceutical landscape even without the Covid-19 portfolio.

Pfizer

Enterprise Analysis

Katarina Kukanova

Pfizer | Enterprise Analysis | Introduction

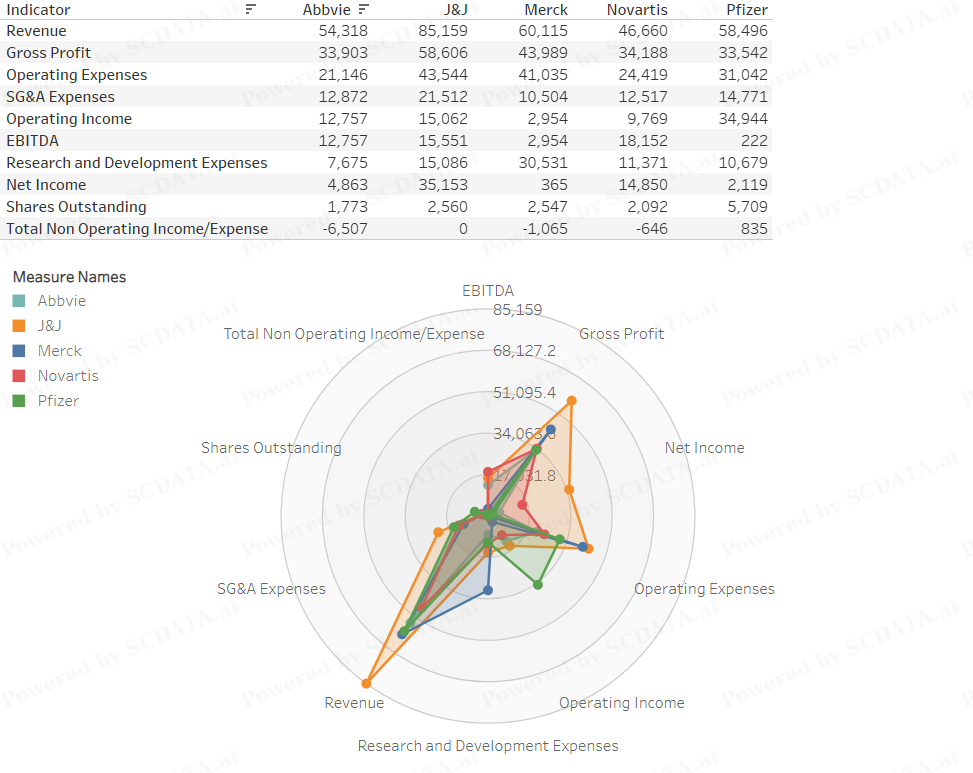

The Enterprise Analysis of Pfizer is based on SCDATA (2022), enriched by data from Pfizer 2023 Annual Report and 2023 financial data of major competitors Johnson & Johnson, AbbVie, Roche, Novartis, Merck & Co. published by macrotrends.

The 2022 Enterprise Analyses focuses on following SC Data indicators: size, profitability, valuation and financial health.

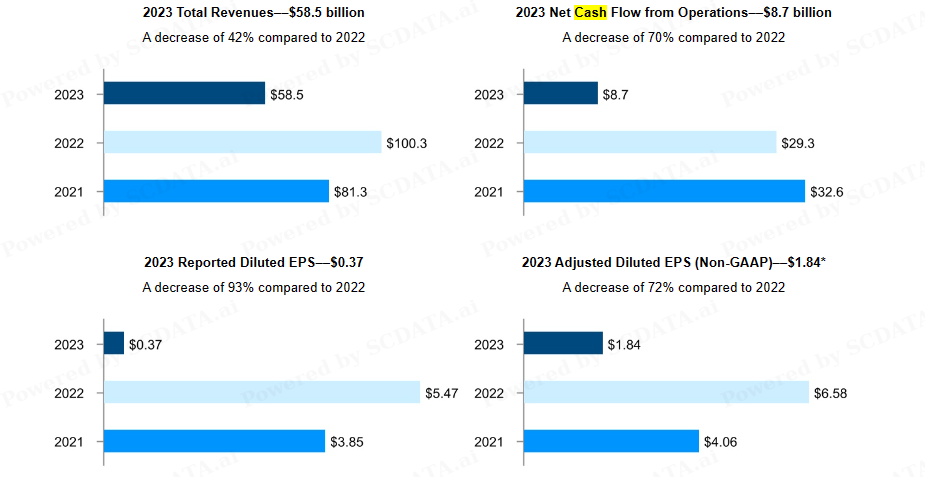

Pfizer´s Financial Performance | Annual Report | 2023

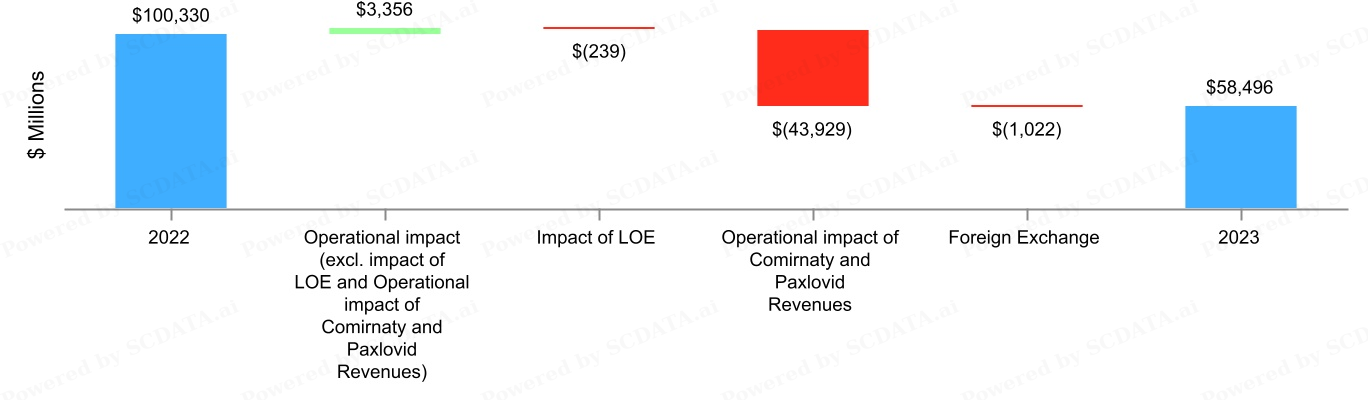

Pfizer | Annual Report 2023 | Net Change in Total Revenues | 2022 - 2023

Total revenues decreased $41.8 billion, or 42%, to $58.5 billion in 2023 from $100.3 billion in 2022, reflecting an operational decrease of $40.8 billion, or 41%, as well as an unfavorable impact of foreign exchange of $1.0 billion, or 1%. The operational decrease was primarily driven by significant declines in revenues from Comirnaty and Paxlovid, including a $3.5 billion non-cash revenue reversal for Paxlovid recorded in the fourth quarter of 2023. Excluding contributions from Comirnaty and Paxlovid, Total revenues increased 7% operationally, reflecting an increase in revenues from Nurtec ODT/Vydura and Oxbryta; revenues from Abrysvo, primarily driven by the launch of the older adult indication in the U.S.; as well as continued growth from the Vyndaqel family and Eliquis; partially offset by a decline in Ibrance (Pfizer, Annual Report 2023).

Macrotrends | Financial Performance | Comparison to Its Major Competitors | 2023

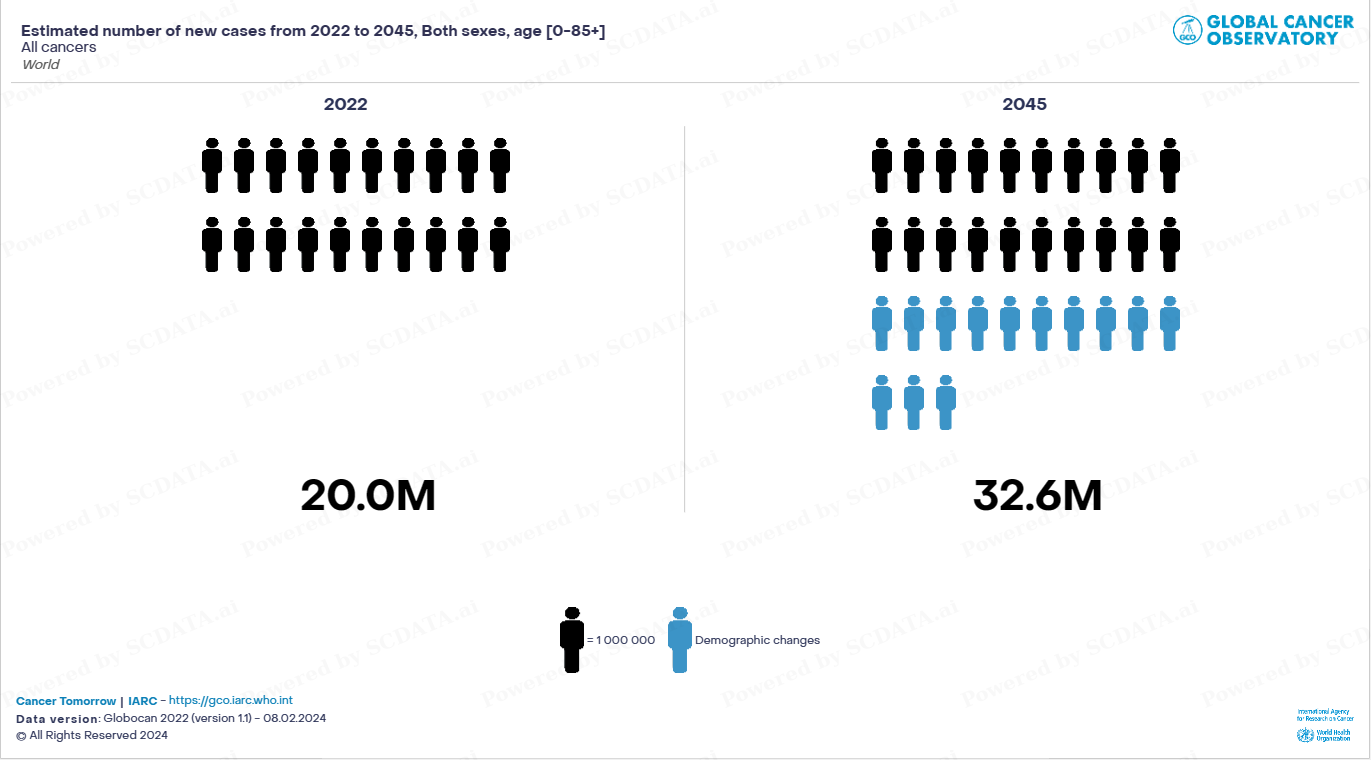

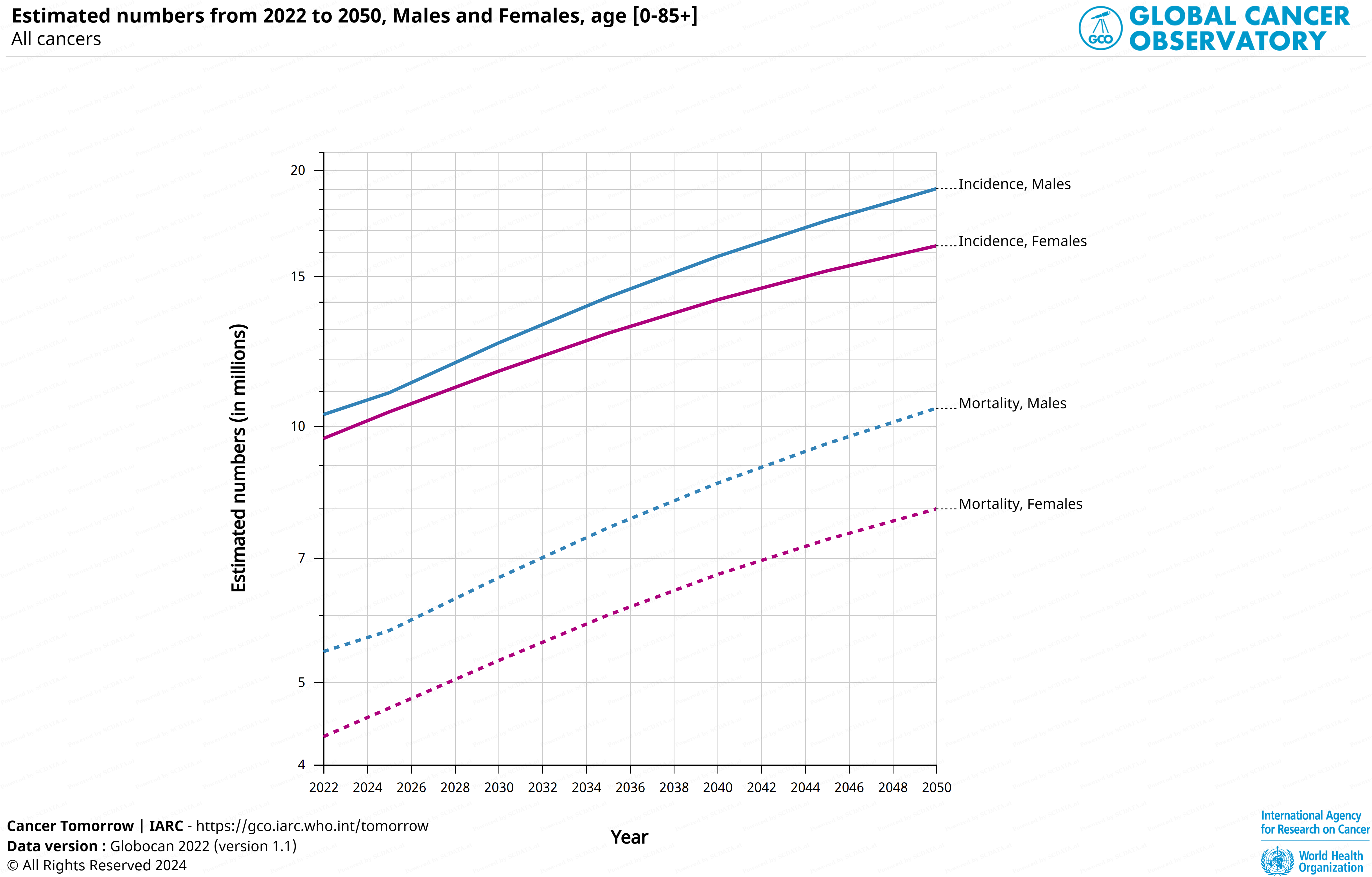

Future of Oncology Incidence

GLobal Cancer Observatory

Global Cancer Observatory | Oncology Trends

Global Cancer Observatory | Oncology Trends

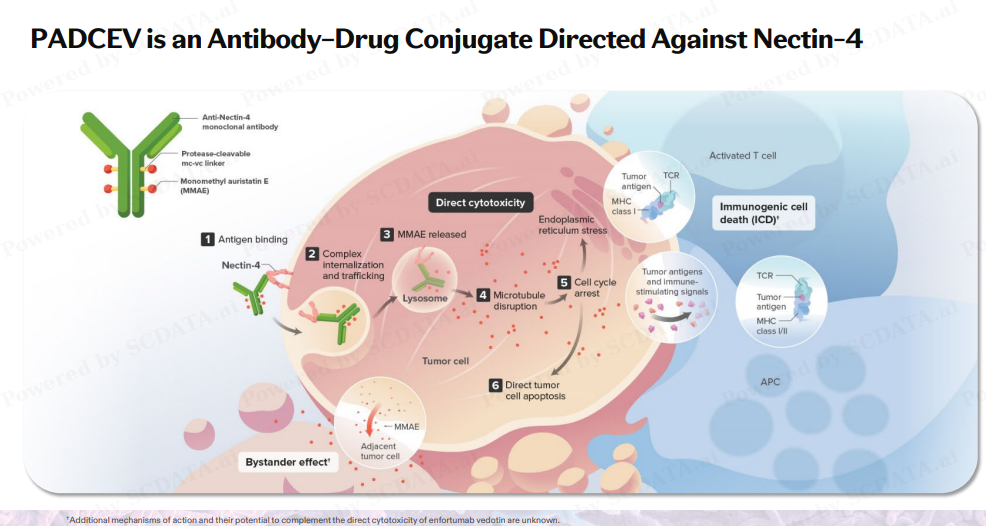

Pfizer | Acquisition of Seagen 2023 | Enterprise and ADC portfolio Analysis

Antibody Drug Conjugates | Mode of Action | Pfizer

Seagen | ADC Portfolio

|

|

|

|

Seagen Acquisition 2023 | Summary

Seagen

The chart shows long-term high gross margin for high value innovative Seagen antibody-drug portfolio, composed of Adcetris, Padcev, Tukysa and Tivdak medicines targeting Hodgkin Lymphoma, T-Cell Lymphoma, Urotherial Cancer, Breast Cancer and Cervival Cancer.

Long-term negative operating margin as well as net margin and ROA of Seagen Inc. can be attributed to challenges biotech companies are facing while developping breakthrough medicines and need for high investments into the research and development. Exceptionally high operating margin, net margin and ROA in 2020 are a result of high increase in revenues in 2020 to $2.2 billion, compared to $916.7 million in 2019. This growth was driven by $975.2 million collaboration and license agreement revenues from cooperation with Merck in 2020, the U.S. launches of PADCEV in December 2019 and TUKYSA in April 2020, as well as higher ADCETRIS net product sales.

Pfizer

SWOT Analysis

|

Strengths:

|

Weaknesses:

|

|

Opportunities:

|

Threats:

|

Conclusion

Pfizer’s current position in the pharma/biotech competitive landscape is more vulnerable compared to its major peers due to the decline of Covid portfolio sales, discontinuation of certain programs, patent expirations for some of its key products and failure of some new drug candidates. This was reflected in significant decline of its stock prices and weakened position in several rankings compared to its competitors.

The acquisition of Seagen Inc. with its valuable ADC portfolio in 2023 is in this context not only a bold risk mitigation strategy (high success rate of ADCs portfolio) but also a smart strategic investment in the company's future growth in oncology pipeline.

Investing in Pfizer stock at current price could be a wise decision for long-term investors. Despite current weaknesses and threats, Pfizer's strengths, including its diverse product portfolio, brand reputation and robust pipeline with promissing late stage candidates, position the company well for the future.

In addition, opportunities in emerging markets, the aging global population and advances in technology could drive Pfizer's sales and profitability in the coming years.

However, investors should also consider their individual risk tolerance and investment objectives before making a decision. It is essential to conduct thorough research, consider the objective of this presentation, review Pfizer's financial statements and consider the opinions of financial experts before investing. Investors should be also prepared to hold the stock for the long term, as there may be short-term market fluctuations due to the inherent risks in the pharmaceutical industry.