Walmart's Industry Classification: Consumer Staples/Food & Staples Retailing/Food & Staples Retailing/Hypermarkets & Super Centers

3

In 2023, Walmart's closest competitors in the U.S. Food & Staples Retailing are (1) Costco, (2) BJ's Wholesale, and (3) Price Smart

3/50

Walmart is mainly a B2C company, working with various distributors

4

Note: The supply chain mapping provides a value chain mapping, not Walmart's actual supply chain. Walmart also works directly with major consumer goods manufacturers, which is not reflected in the supply chain mapping.

4/50

Enterprise Distribution - Enterprise Distribution

6

In 2023, US Consumer Staples/Food & Staples companies come mostly from California.

6/50

Typical Firm Performance by Region - Profit Distribution

7

The firms in Arkansas are much bigger than those in California

7/50

Typical Firm Performance by Region - Profit Distribution

8

The firms in Arkansas are much bigger than those in the rest of the countries

8/50

Concentration and Competition Intensity - Total Revenue

9

US Food and Staples Retailing Industry is dominated by a few large firms

9/50

10

In 2023, globally, Walmart's closest competitors are (1) Costco (US), (2) Carrefour (France), (3) E-Mart (South Korea)

10/50

Profitability Distribution by Industry

11

US Food & Staples Retailing industry: > 50% of companies make a profit in 2023.

11/50

Industrial Trend - Industry Total Size

12

US firms are the largest and growing, stable operating income and net income. However, US and China markets are very competitive.

12/50

Revenue vs. Cost

15

Walmart is the largest retailer. Top retailers have similar Total Revenue/Total Cost ratios.

15/50

Profit vs. Cost - Gross Profit

16

Walmart has a higher gross margin than Costco.

16/50

Profit vs. Cost - Operating Income

17

Walmart’s and Costco’s operating profitability are above the industry average. CVS is very profitable

17/50

Profit vs. Cost - Operating Income

18

Walmart’s Net Income performance is below average.

18/50

Operating Margin vs. Revenue

19

Walmart and Costoc have similar operating margin, CVS and SYY have higher operating margins.

19/50

Return on Assets vs. Liability Asset Ratio

20

Walmart is the second best on both ROA and financial health. Costco is the best on both.

20/50

Enterprise Ranking - Total Revenue

22

Walmart: 1st in size

Costco: 3rd in size

22/50

Enterprise Ranking - Operating Margin

23

Walmart: 15th

Costco: 13th

in Operating Margin

23/50

Enterprise Ranking - Operating Margin

24

Walmart: 12th

Costco: 5th

in Net Margin

24/50

Enterprise Ranking - Return on Assets

25

Costco ranks the 1st, Walmart ranks the 11th on ROA.

25/50

KPI Examination - Standard KPI examination (Walmart)

26

Walmart's Current Ratio is lower than 1.

Walmart's Net Income Growth Rate is negative.

26/50

KPI Examination - Standard KPI examination (Costco)

27

Costco's operational efficiency metrics are better than Walmart's, contributing to Costco's higher profitability metrics than Walmart's.

27/50

Enterprise Comparison - Size

30

Walmart is larger than Costco in size

30/50

Enterprise Comparison - Profitability

31

Except for Gross Margin, Walmart’s profitability is lower than Costco

31/50

Enterprise Comparison - Profitability

32

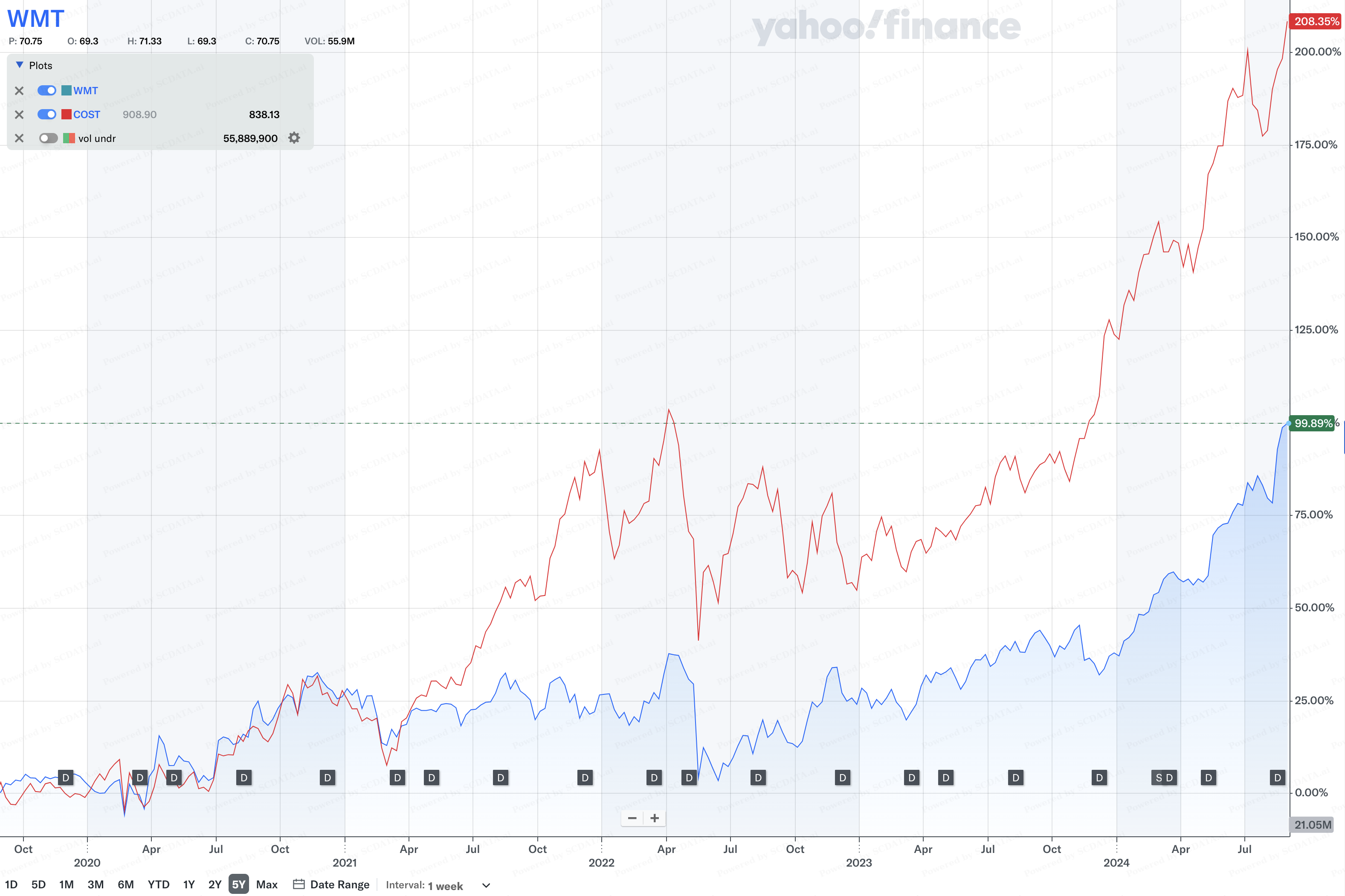

Walmart has lower investment returns than Costco – explains the two companies’ stock market performance difference.

32/50

Enterprise Comparison - Key Indicators

33

Walmart has better Gross Margin, but either equal or worse performance in almost all areas: profitability, growth, financial health and efficiency

33/50

Enterprise Trend - Size

36

Both companies’ revenues are increasing. Walmart’s profitability has been fluctuating, while Costco’s profitability has been steadily increasing.

36/50

Enterprise Trend - Profitability

37

Gross margin: Walmart and Costco have remain stable. However, Walmart has seen declines in operating margin, net margin, and ROA since 2016, while Costco has seen an increasing trend.

37/50

Enterprise Trend - Financial Health

38

Costco's current ratio (>1) indicates good short term financial health.

Costco's long-term debt has been lower than Walmart's, indicating Costco relies more on equity financing and has less long-term debt, indicating potentially lower financial risk.

38/50

Enterprise Trend - Growth

39

Walmart’s growth rates have been dominated by Costco’s since 2016 except the Net Income Growth Rate in 2020 and the Free Cash Flow Growth Rate. The growth rates are strong indicators of stock market performance.

39/50

Enterprise Breakdown - Revenue

42

Walmart’s COGS is lower than average, but has high SG&A cost.

Costco’s COGS is higher than average but is lower on other costs.

42/50

Enterprise Breakdown - Revenue

43

The two firms’ liability-equity ratios are similar.

The difference lies in Costco’s having a bigger portion of short-term liabilities, whereas Walmart has a bigger portion of long-term liabilities.

43/50

Enterprise Breakdown - Liability-Equity

44

Walmart has lower “Cash and Cash Equivalent” and higher “Property Plant and Equipment” than Costco.

44/50

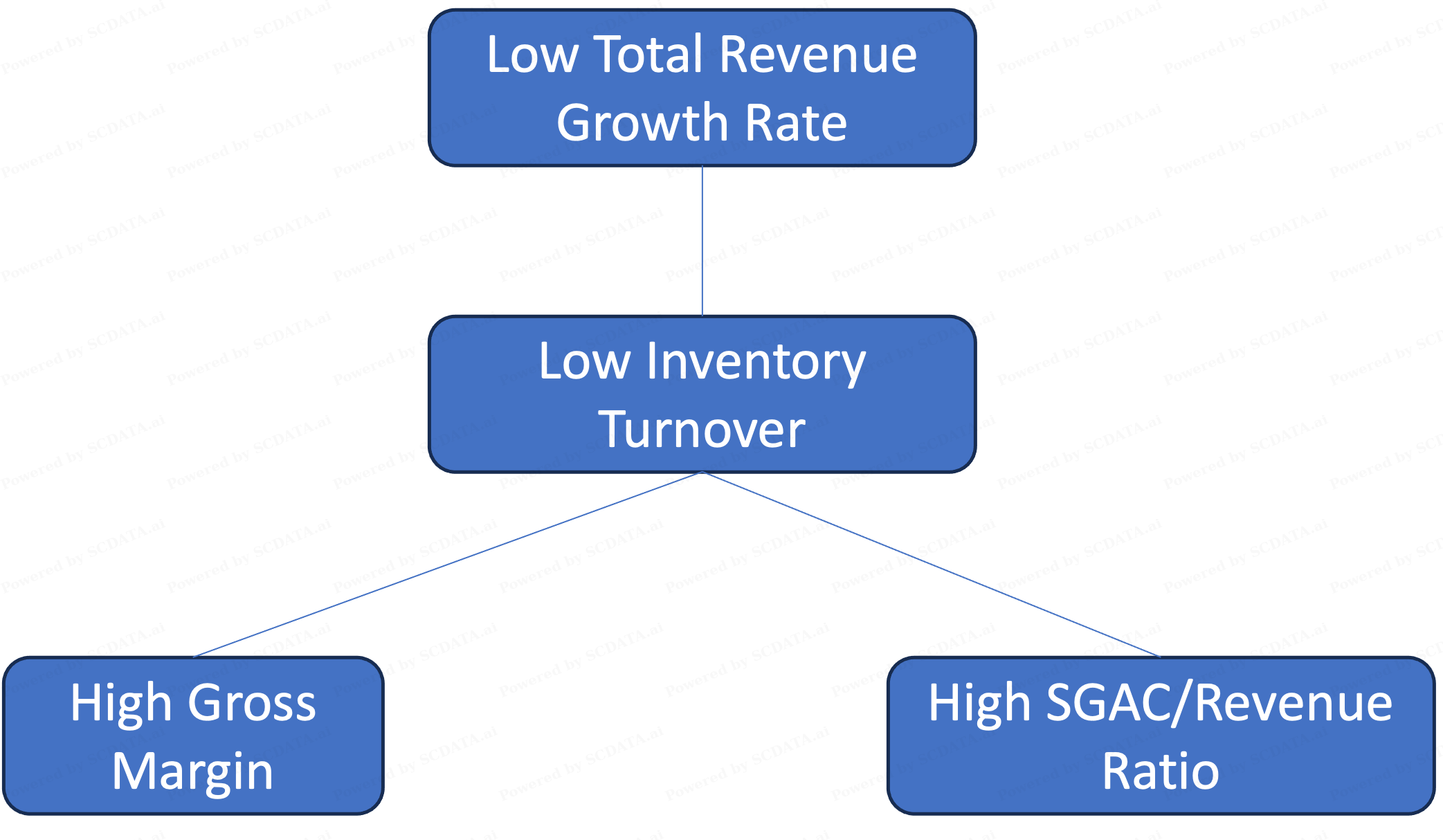

Value Driver Analysis

45

Inventory turnover is negatively correlated with Gross margin.

Intuition: cheaper products sell faster

45/50

Value Driver Analysis

46

“SGAC/Total Revenue” is negatively correlated with “Inventory Turnover”.

Intuition: High operational efficiency means more efficient inventory management.

46/50

Value Driver Analysis

47

“Total Revenue Growth Rate” is negatively correlated with “Gross Margin”.

Intuition: Efficiency is higher for high-volume, low-margin businesses

47/50