Intel

Competitive Intelligence and Benchmarking

Jeffrey Zhang

Supply Chain Management

Rutgers Business School

Intel

One of the world’s largest semiconductor manufacturers, known for designing and producing microprocessors and integrated circuits used in most personal computers.

Operates globally with manufacturing, research, and development facilities in the United States, Ireland, Israel, and other countries.

Named one of the World’s Most Admired Companies by Fortune in 2023.

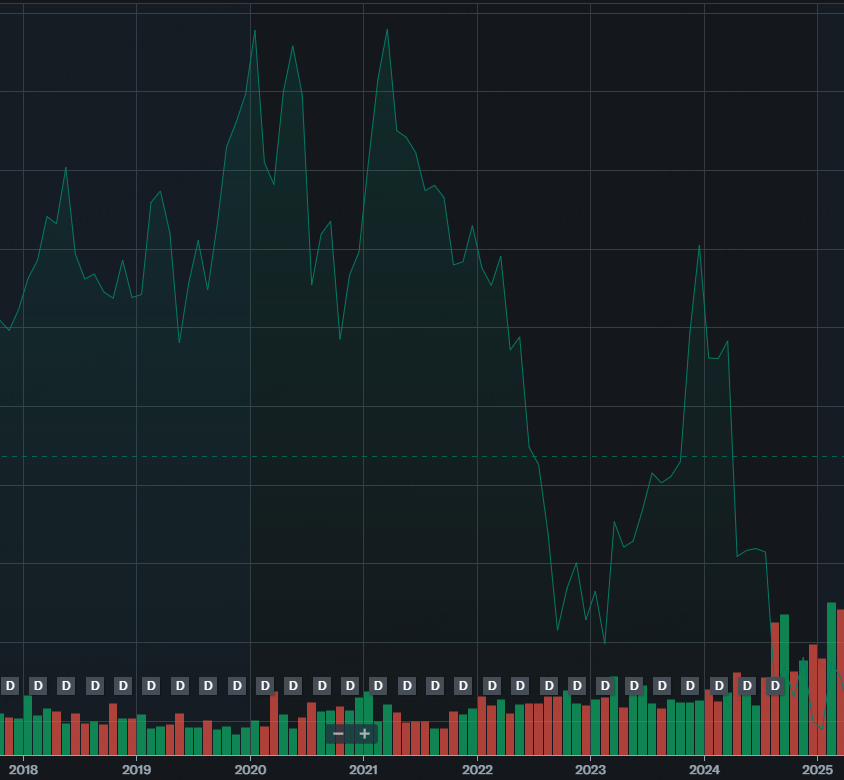

Stock Market Performance 2018-2025

Industry Analysis

Concentration and Competition Intensity

How concentrated is the industry?

Concentration & Competition Intensity Summary

Industry Analysis

Trend Analysis

The potential and risk of the industry?

Industry Potential: Summary

Although Semiconductors and Semiconductor Equipment are closely related industries, they have distinct trend, potential and risk.

The Semiconductor industry saw growth throughout the years while Semiconductor Equipment revenue stayed around the same level.

The Semiconductor Equipment industry had consistently had higher return on assets then the Semiconductors.

Semiconductors have the potential because technology keeps advancing year over year, but the future remains to be seen.

Meanwhile Semiconductor Equipment has better financial health than Semiconductors .

Industry Risk: Summary

Industry Analysis

Value Chain & Industry Comparison

Expand or stay focused?

More valuable and better potential Industries - how to measure?

Gross margin: value added

Size, profitability, productivity and growth

Value Chain & Industry Comparison: Summary

None of the upstream industries of semiconductor equipment has sufficiently high value added that is worthy of the entrance barrier.

Semiconductor Equipment is an industry that a Semiconductor company depends on, it’s not similar at all in value added, profitability, and productivity.

Expanding into Semiconductor Equipment will not make a Semiconductor company richer.

Competition Positioning

Profit Comparison

Where do I stand in the competition landscape?

Profit Comparison: Summary

The big three, NVDA, AVGO and INTC, are comparable in revenue.

Among them, INTC is least profitable, had the lowest return on assets and also the highest risk.

Semiconductors is a tough industry: Many smaller semiconductor companies are in trouble from the perspective of profitability or financial health or both.

Competition Positioning:

Multiple Rankings

Where is the company ranked relative to its competitors?

Competition Positioning

KPI Examination

Anomalies and potential issues undetected?

Ranking and KPI Examination: Summary

INTC: strong revenue but weak profitability, confirming prior analysis.

In addition, INTC had slower profit growth but good operating efficiency.

Although INTC performed the worst among the big three, it’s still better than many smaller semiconductor companies.

Enterprise Diagnosis:

My strengths and weaknesses?

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Major Competitors to Intel

Enterprise Diagnosis

Company trend

Strengths and Weaknesses: Summary

Comparing the top 3 semiconductor companies, INTC is comparable on revenue but inferior on profits in recent years.

INTC had the lowest labor productivity constantly.

NVDA improved its asset turnover in recent years

Value Driver Analysis

Performance drivers

Breakdown Analysis

Root Causes

Summary